Last year around this time our clients were telling us they barely had time to list a property before leads started pouring in. Leasing was (relatively) easy: post an address, watch the leads and applicants pile up, sign a lease.

But now? Lead volume has been cut in half. The difference in leads between summer 2022 and summer 2023 is “staggering,” one client told us and the decrease in leads has unsurprisingly led to longer days on market for many single-family rental property managers.

What to do? First let’s look at some data points and then we’ll get into the ideas.

Longer Days On Market in the Data

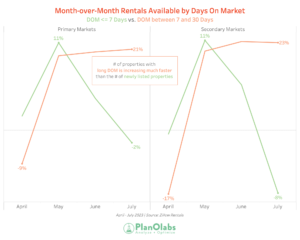

The PlanOlabs team tracks the number of single-family rental properties that have been on the market for less than seven days (newly listed inventory) and for between seven and 30 days (aged inventory) across 30 markets nationwide. Over the last four months, we are seeing a clear divergence in the trend of newly listed properties versus aged inventory.

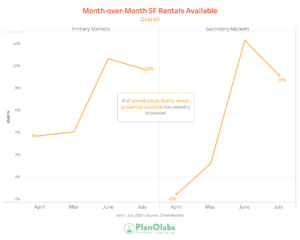

Before we made any conclusions, we wanted to confirm the overall trend in the number of single-family rental homes posted online. This number has consistently gone up in both primary and secondary markets according to the chart below showing the percentage growth month over month.

Now we can break this overall number down into our days on market categories: less than seven days (newly listed inventory) and 8-30 days (aged inventory). The chart below shows that primary markets have seen a 21% increase in aged inventory and secondary markets are right there with a 23% increase MoM in July. Contrast these increases with a -2% and -8% decrease in newly listed inventory for primary and secondary markets, respectively.

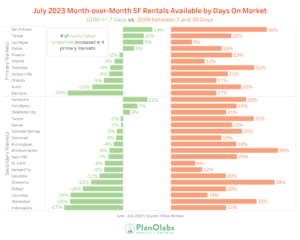

Finally, we broke it down by market in the chart below. Note there are only four primary markets and three secondary markets that saw an uptick in newly listed single-family rental homes.

The data shows that single-family rental properties are taking a long time to lease and not as many new listings came on in the month of July. This data is also backed by anecdotes from our clients saying that leads have decreased significantly.

Leasing in a Slowdown

Here is what some of our clients are doing to lease properties in a challenging leasing environment:

Pre-Marketing / Pre-Leasing

If you read nothing else, do this one. Be upfront with your resident when they sign the lease that you have a pre-marketing period leading up to their move-out. By pre-marketing the property, you have an opportunity to generate demand, receive feedback on the price, and create a waiting list of leads. Use PlanOmatic’s Single Primary Photo service to get one nice exterior of the home, or create a branded image that says “Photos Coming Soon.”

Call Upcoming Renewals

Our clients have recently created more formal workflows around this. They call residents around 60 days before lease-end to have a conversation about their lease. What do they like about the home so far, what are their plans moving forward, is there anything that could be improved about their experience, etc? This conversation not only provides valuable insights for the property manager, but also creates a positive touchpoint between the property managers and the resident (and maybe it will convince the resident to renew). I think that’s called a win-win.

Beautiful Photos and 3D Tours

Sure we are biased, but this is real. Zillow rewards properties that have a 3D tour. Prospective renters are more likely to click on and look at homes that have nice photos and a 3D tour. We have done studies showing that both lead data and days on market benefit from quality marketing assets.

Offer Referral Bonuses to Existing Residents

An operator brought this up during a recent IMN Conference and it is worth bringing up here. They target their referral offer to their best residents (with the logic that good residents will attract other good residents), and they make the offer dynamic based on market need.

Explore All ILS / Listing Options

Work with your syndication engine to ensure you are maximizing the property’s exposure. Here are some of the non-Zillow Group options that our clients are testing:

- Zumper

- Rental Beast

- Dwellsy

- Apartment List

- Local MLS boards

Pay-per-Click Advertising (?)

We are putting this here with a question mark. Our clients have told us they are trying this but they don’t have results yet. Does anyone have a success story here when it comes to leasing properties through pay-per-click advertising?

Summary

- This is a much more challenging leasing environment compared to what we saw in 2022.

- Vacant properties are sitting on the market longer and the number of newly listed vacant properties decreased in July.

- Property managers are forced to get creative in filling vacancies.